How Mobile Trading Platforms Are Changing Forex Access

Accessing the Forex market has never been easier, thanks to the rise of mobile trading platforms that put powerful tools directly into the hands of individual investors. These apps allow users to monitor markets, execute trades, and manage portfolios anytime, anywhere, breaking down traditional barriers that once limited trading to professional environments. For those seeking reliable options, 海外fx おすすめ highlight platforms that combine security, user-friendly interfaces, and advanced trading features. By democratizing access and providing real-time data, mobile platforms are reshaping how traders approach the global currency market. This article explores the impact of mobile technology on Forex accessibility and investor empowerment.

Expanding Market Accessibility

Mobile trading platforms have made forex markets more accessible to individual traders worldwide. Previously, trading was often limited to institutional investors or individuals with dedicated trading setups. Mobile applications allow users to execute trades directly from smartphones or tablets, removing the need for stationary equipment or complex setups. This accessibility encourages participation from a wider audience, including novice traders who may have been hesitant to enter the market due to perceived technical barriers.

Providing Real-Time Data and Analytics

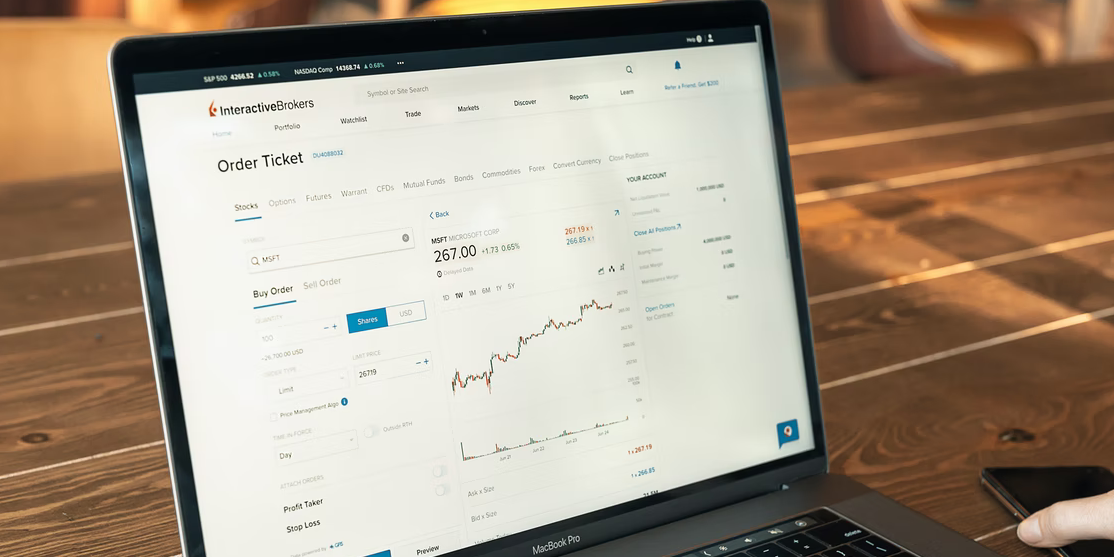

A critical component of successful forex trading is timely and accurate information. Mobile platforms provide real time data on currency pairs, market trends, and economic indicators. Users can monitor price movements, set alerts, and access analytical tools without delay. This immediacy allows traders to respond quickly to market fluctuations and make informed decisions on the go. By delivering the same type of analytics once confined to desktop systems, mobile platforms democratize decision-making and enhance trading responsiveness.

Enhancing User Experience Through Intuitive Interfaces

Mobile trading applications are designed with user experience in mind, offering intuitive navigation, clear dashboards, and simplified trade execution. Complex functions, such as chart analysis, order placement, and portfolio management, are streamlined for mobile use. This design focus reduces the learning curve for new traders and supports efficient use for experienced investors. A well-organized interface encourages consistent engagement and allows traders to manage multiple positions seamlessly from a single device.

Supporting Flexible Trading Schedules

Forex markets operate 24 hours a day, five days a week, which can be challenging for traders with other commitments. Mobile trading platforms provide the flexibility to engage in the market from virtually any location at any time. Whether monitoring trades during a commute, traveling, or managing positions outside traditional work hours, users can maintain active participation. This flexibility enables traders to respond to global events promptly, enhancing opportunities for profit and risk management.

Promoting Risk Management and Control

Many mobile trading applications include integrated risk management features, such as stop loss orders, margin alerts, and portfolio monitoring tools. These functions allow traders to manage exposure and protect capital in volatile markets. By having these controls readily accessible on mobile devices, users can make adjustments quickly and maintain oversight of their positions. The combination of convenience, real-time data, and built-in safeguards empowers traders to exercise greater control over their investment strategies.

Mobile trading platforms have fundamentally changed access to forex markets by expanding participation, providing real-time data, enhancing user experience, supporting flexible schedules, and promoting risk management. By leveraging mobile technology, traders can operate with increased convenience, control, and responsiveness. This shift has democratized forex trading, making it more inclusive while maintaining the sophistication necessary for informed investment decisions.…

When it comes to bad credit, insurance companies often consider you a financial risk. That’s why they raise your premiums if you have a lower credit score.

When it comes to bad credit, insurance companies often consider you a financial risk. That’s why they raise your premiums if you have a lower credit score. While it’s illegal in many places for employers to pull your credit score directly, some still do. This can be especially true if you’re applying for a job that involves handling finances or working in the banking industry.

While it’s illegal in many places for employers to pull your credit score directly, some still do. This can be especially true if you’re applying for a job that involves handling finances or working in the banking industry.

Finally, don’t be afraid to seek out professional advice. Speak to a financial advisor or accountant and ensure you have all the information you need to protect your finances after retirement.

Finally, don’t be afraid to seek out professional advice. Speak to a financial advisor or accountant and ensure you have all the information you need to protect your finances after retirement.

If you’re thinking about investing in cryptocurrencies, it’s essential to do your research first. You should understand how they work and what factors can affect their price. Cryptocurrencies are volatile, so their prices can go up and down very quickly. It would help if you were prepared for this and had a strategy for dealing with it. One important thing to remember is that you should never invest more than you can afford to lose. Cryptocurrencies are a risky investment, so it’s important only to put in as much money as you feel comfortable losing. Once you’ve done your research and decided how much you want to invest, you need to find a place to buy and store your cryptocurrencies.

If you’re thinking about investing in cryptocurrencies, it’s essential to do your research first. You should understand how they work and what factors can affect their price. Cryptocurrencies are volatile, so their prices can go up and down very quickly. It would help if you were prepared for this and had a strategy for dealing with it. One important thing to remember is that you should never invest more than you can afford to lose. Cryptocurrencies are a risky investment, so it’s important only to put in as much money as you feel comfortable losing. Once you’ve done your research and decided how much you want to invest, you need to find a place to buy and store your cryptocurrencies. The most important thing you can do when learning to trade cryptocurrency is practice different trading strategies. By doing this, you will see which strategies work best for you and which don’t. There are a lot of other resources out there that you can use to help you learn different trading strategies. One of the best ways to learn various trading strategies is to join a cryptocurrency trading group. There are many other groups out there that you can join and they will usually have experienced traders who can help you learn. You can also find many different resources and tutorials online that can teach you different trading strategies.

The most important thing you can do when learning to trade cryptocurrency is practice different trading strategies. By doing this, you will see which strategies work best for you and which don’t. There are a lot of other resources out there that you can use to help you learn different trading strategies. One of the best ways to learn various trading strategies is to join a cryptocurrency trading group. There are many other groups out there that you can join and they will usually have experienced traders who can help you learn. You can also find many different resources and tutorials online that can teach you different trading strategies. If you’re new to the world of cryptocurrency, you may be feeling a bit overwhelmed. That’s perfectly normal! There are so many different coins and tokens to choose from, not to mention all the other exchanges. But don’t worry, we’re here to help. In this guide, we’ll walk you through the basics of cryptocurrency trading. The next thing you need to do is pick a currency to trade. There are dozens of different coins and tokens available, so it’s important to do your research before picking one. Once you’ve chosen a currency, the next step is to find an exchange where you can buy and sell it.

If you’re new to the world of cryptocurrency, you may be feeling a bit overwhelmed. That’s perfectly normal! There are so many different coins and tokens to choose from, not to mention all the other exchanges. But don’t worry, we’re here to help. In this guide, we’ll walk you through the basics of cryptocurrency trading. The next thing you need to do is pick a currency to trade. There are dozens of different coins and tokens available, so it’s important to do your research before picking one. Once you’ve chosen a currency, the next step is to find an exchange where you can buy and sell it.

One of the biggest financial mistakes you can make is living beyond your means. Just because you can afford to make a particular purchase doesn’t mean you should. If you want to get ahead financially, living below your means is essential and saving as much money as possible. This may mean making some sacrifices in the short term, but it will pay off in the long run.

One of the biggest financial mistakes you can make is living beyond your means. Just because you can afford to make a particular purchase doesn’t mean you should. If you want to get ahead financially, living below your means is essential and saving as much money as possible. This may mean making some sacrifices in the short term, but it will pay off in the long run.

Natural disasters can have a significant impact on the economy. The most direct way they do this is through damage to infrastructure and property.

Natural disasters can have a significant impact on the economy. The most direct way they do this is through damage to infrastructure and property.

One of the best ways to save up for something is to cut back on unnecessary expenses. Take a look at your monthly budget and see where you can make cuts.

One of the best ways to save up for something is to cut back on unnecessary expenses. Take a look at your monthly budget and see where you can make cuts. If you’re looking for a way to save up quickly, consider doing odd jobs. Offer your services to friends and family or post an ad online. You can make some extra cash this way and put it towards your concert ticket fund. Just be sure to keep track of how much money you earn from each job so that you don’t overspend.

If you’re looking for a way to save up quickly, consider doing odd jobs. Offer your services to friends and family or post an ad online. You can make some extra cash this way and put it towards your concert ticket fund. Just be sure to keep track of how much money you earn from each job so that you don’t overspend.

Although there are different kinds of loans that lenders offer, many people struggle to get them. The process of getting an income loan is surprisingly easy. There are lenders out there that can get you approved within minutes, or at least the same day of applying. Some lenders will go as far as to guarantee that you get approved, as they are very confident in their lending abilities.

Although there are different kinds of loans that lenders offer, many people struggle to get them. The process of getting an income loan is surprisingly easy. There are lenders out there that can get you approved within minutes, or at least the same day of applying. Some lenders will go as far as to guarantee that you get approved, as they are very confident in their lending abilities. The second reason you should highly consider getting an income tax

The second reason you should highly consider getting an income tax

The first consideration you should make when choosing a Forex trader is their experience. Knowing how long the person has been trading and what currency pairs they primarily focus on will help you understand if that’s someone who can meet your expectations or not. It is important to note that experience does not necessarily mean that a trader will best suit you.

The first consideration you should make when choosing a Forex trader is their experience. Knowing how long the person has been trading and what currency pairs they primarily focus on will help you understand if that’s someone who can meet your expectations or not. It is important to note that experience does not necessarily mean that a trader will best suit you. You should also learn about the type of trading that they specialize in. There are many different types, and each has its positives and negatives when it comes to choosing a trader. The trader you select should deliver the type of results you are looking for and fit into your strategy.

You should also learn about the type of trading that they specialize in. There are many different types, and each has its positives and negatives when it comes to choosing a trader. The trader you select should deliver the type of results you are looking for and fit into your strategy.

Many, if not all, investors have a primary goal of making more money. It will be unwise to invest in something that will not bring you profit. Cryptocurrency is quite profitable, and it is a shame that many have not realized this. If you are interested in topics related to the digital currency, you will know that the value of

Many, if not all, investors have a primary goal of making more money. It will be unwise to invest in something that will not bring you profit. Cryptocurrency is quite profitable, and it is a shame that many have not realized this. If you are interested in topics related to the digital currency, you will know that the value of  As mentioned in the text, more people in society are interested in Bitcoin and digital currency. With bitcoin, people have found a safe, cheaper, and secure way to send and receive finances. As time progresses, many are adopting the use of Bitcoin.

As mentioned in the text, more people in society are interested in Bitcoin and digital currency. With bitcoin, people have found a safe, cheaper, and secure way to send and receive finances. As time progresses, many are adopting the use of Bitcoin.

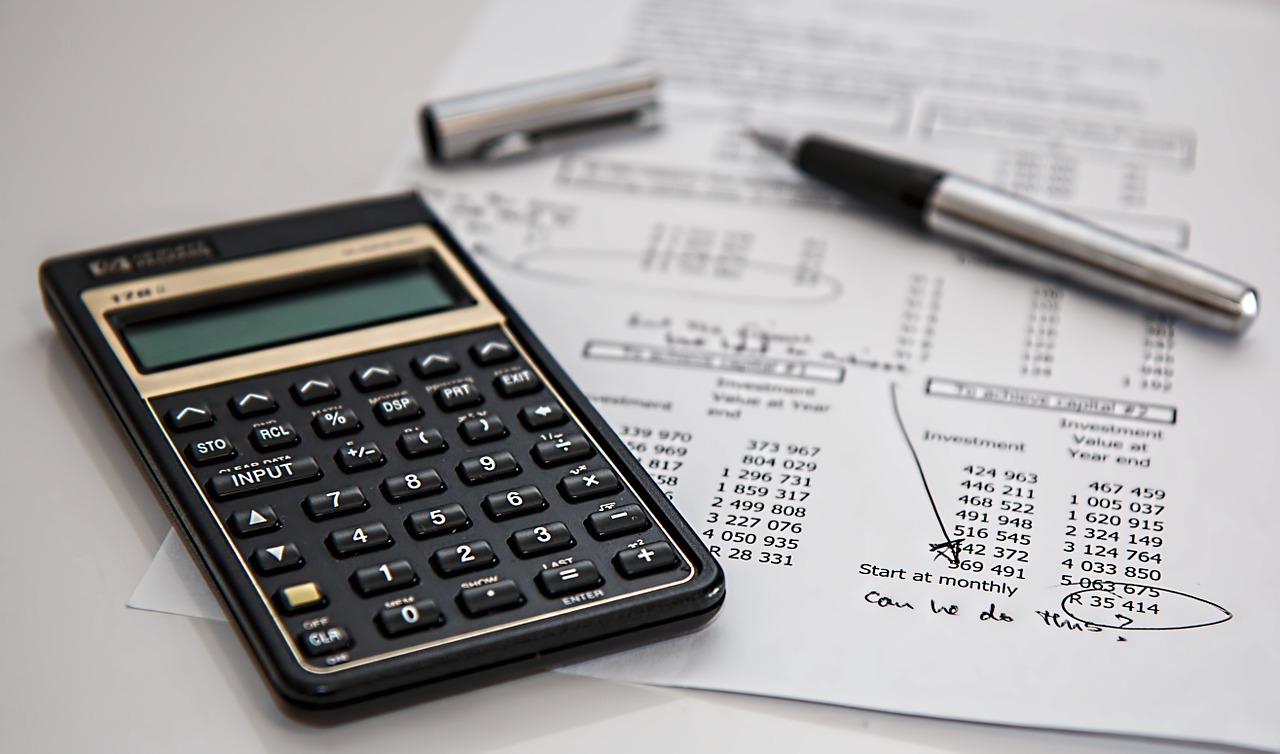

SKP Accountancy Service has the best Accountants In Bromley. You can hire them if you are from the region to keep your business running smoothly and make wise financial decisions. The options you have at hand are hiring an in-house accountant or a professional accounting firm. Hiring an accounting firm is a much better option. Here is why you should try it out.

SKP Accountancy Service has the best Accountants In Bromley. You can hire them if you are from the region to keep your business running smoothly and make wise financial decisions. The options you have at hand are hiring an in-house accountant or a professional accounting firm. Hiring an accounting firm is a much better option. Here is why you should try it out. When choosing to hire

When choosing to hire  You will receive commercial and tax strategies and opinions from an accounting firm that guides you towards optimizing your tax burden. You can count on a fully updated professional team that will help you make the right decisions for your company’s growth. On the other hand, an accounting firm will better handle the journal entries.

You will receive commercial and tax strategies and opinions from an accounting firm that guides you towards optimizing your tax burden. You can count on a fully updated professional team that will help you make the right decisions for your company’s growth. On the other hand, an accounting firm will better handle the journal entries.

Another advantage of filing your taxes on the tax software or electronically is to save time since it is very simple. E-filling of the returns can be done by everyone as long they are connected to a strong WI-FI connection. The software is very simple to use and intuitive regardless of your education level. You do not have to enroll in tax code training. The tax software or IRS website asks for basic personal details, so that can transfer only the information that is relevant based on the information asked and the previous returns.

Another advantage of filing your taxes on the tax software or electronically is to save time since it is very simple. E-filling of the returns can be done by everyone as long they are connected to a strong WI-FI connection. The software is very simple to use and intuitive regardless of your education level. You do not have to enroll in tax code training. The tax software or IRS website asks for basic personal details, so that can transfer only the information that is relevant based on the information asked and the previous returns.

All the Right Channels

All the Right Channels Your Security

Your Security